The winter holiday season represents a key sales surge for CPG brands in categories like seasonal candy, chocolate, cookies, and other packaged sweets. How can retailers ensure they are mastering holiday in-store execution? While everybody loves a holiday tradition, the traditional retail playbook may not be the answer.

We have the data by the numbers.

Tradition Reigns Supreme at the Holidays

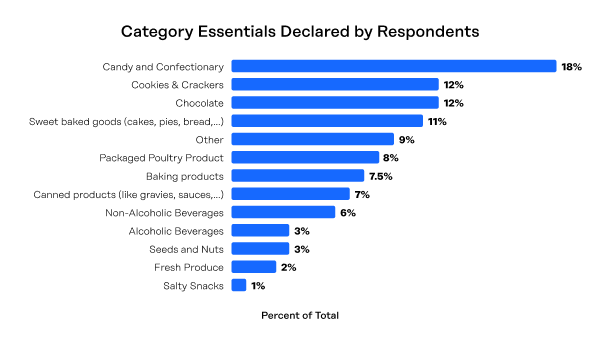

According to recent Premise shopper store visits, 70% of shoppers reported they were eager to buy the same traditional “holiday essentials” they purchase year after year. By “essentials,” most shoppers mean candy, chocolate, and sweets with or without festive flourishes like holiday-themed packaging.

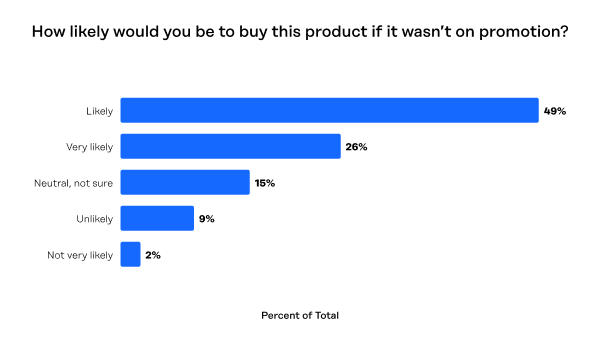

Because of the reliability of seasonal sales, retailers often heavily promote these treats, generally by discounting prices, in anticipation of celebratory purchases. However, the data indicated that product visibility, not price, is the key factor in products flying from the shelves.

Visibility vs. Price Promotions at the Holidays

Shoppers reported that price promotions would not affect whether they buy their seasonal essentials. What matters most to shoppers is whether or not these items are easy to find.

An overwhelming 77% of respondents found notable in-store holiday displays for candy, cookies, and other sweets and desserts they consider “holiday essentials.” In 74% of cases, these spotlighted shelving sections grouped holiday products separately, away from non-seasonal alternatives consumers reported that they buy year-round. Furthermore, just 14% of the sweets and desserts identified as holiday essentials are holiday-only varieties that can’t be found at other times of the year, even though they’re positioned as limited-time exclusives.

Despite focus on visibility, discounts still dominated retailer holiday activations, with 40% of identified holiday essentials on promotion – mostly through direct price-offs or multi-buy promotions, with store loyalty promotions and special super-sized offerings bringing up the rear.

The data suggests that brands are overleveraging on discounts. A data-driven course correction could be just what’s in the (foil-wrapped holiday) cards for your CPG brand.

How CPG Brands Can Leverage Data to Celebrate a Festive Bottomline

Premise Contributors’ store visits revealed key findings for CPG brands:

Focus Less on Price Discounts – 72% of shoppers judged current discounts as consistent with past years. With little pricing disruption to entice purchasing urgency, retail holiday candy and sweets promotions may simply fall flat–or worse, devalue these categories by normalizing deal expectations.

Track Competitors’ Promotions at Store-Level – Legacy solutions track broad pricing patterns but aren’t able to drill down to the store level. They’re also slow to report, thus preventing brands the opportunity to instantaneously adjust to the competition. Premise’s insights allow brands to track competitor promotions in real-time, allowing you to decide how to compete while shoppers are still in the holiday spirit.

Leverage Data-Driven In-Store Executions – Premise’s granular data allows CPG brands to remedy execution gaps on the fly. With shoppers shouting loud and clear that they are looking for product visibility during the holidays, ensure that your planned in-store executions are being honored by each and every store.

At the holidays, we want to wonder what’s in our stockings, not how our end-of-year balance sheet is going to look. With store-level competitive intelligence, you can ensure you are giving your loyal customers what they want this holiday season.