This is part two of our 2-part series on Halloween consumer spending. See part 1 for our analysis of pre-Halloween spending habits.

New consumer spending research from Premise reveals enlightening insights into how shoppers purchase for Halloween across international markets. By examining data in four countries (US, Mexico, Colombia, and Brazil), and across three waves in September and October, we can recommend key actions CPG brands should take to win Halloween sales.

It’s Never Too Soon to Decorate a Haunted House

The research found most Halloween purchasing happens well before the scariest night of the year. More than 88% of shoppers surveyed had started or completed shopping by October 20th. Shoppers indicating they had “everything they need” increased significantly in early October across the US (20%), Colombia (13%), Brazil (10%) and Mexico (8%). However, 50% still had purchases left to make 10 days before Halloween.

Halloween shopping activity changed as the big day approached. Early shoppers hit the stores for 12-foot skeletons, flying bats, and other spooky Halloween decor. But later, that spending shifted to more immediate needs for the big day, like costumes and candy. American and Colombian shoppers tended to start with home decor in September before shifting to ready-to-wear costumes and candy in October. While less pronounced, similar patterns emerged in Mexico and Brazil.

The Scary Truth about In-Store Activations

According to Premise’s research, in-store displays peaked in mid-October. Shoppers rated in-store Halloween activations as most timely 10 days pre-Halloween, especially in the US, where favorable ratings about in-store displays rose 10% since late September.

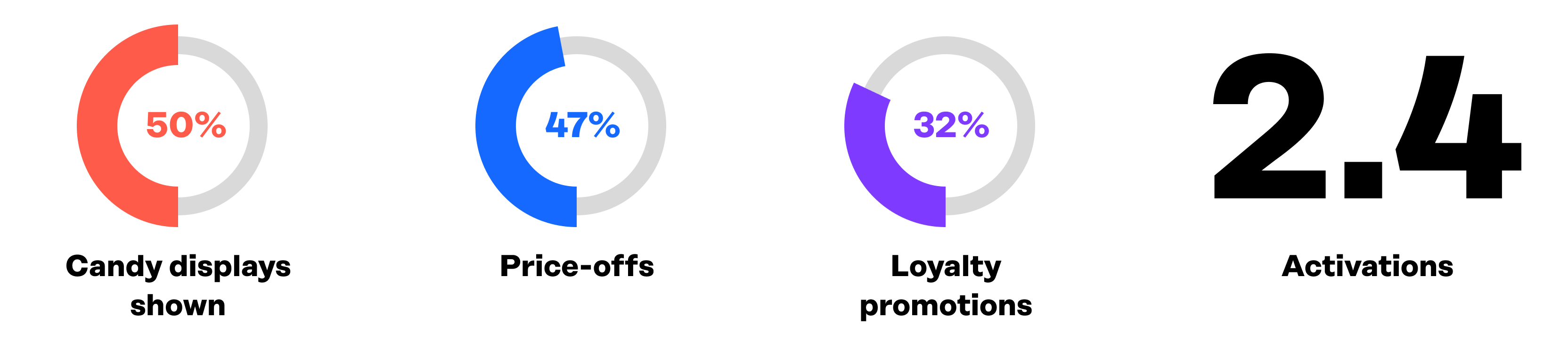

Displays and promotions vary. Half of US displays featured candy/chocolate, while costumes and decor dominated in LatAm. US stores averaged 2.4 activations each. We found promotional activities in one-third of stores. In those stores, most (47%) were direct discounts off of the product’s price. Loyalty promotions were the second most common type, at about 32% of activations.

Key Halloween Takeaways for CPG Brands

The data points to key takeaways around Halloween purchasing habits:

- Retailers should shift priority categories for promotions and merchandising according to shopping habits. Earlier in the season for decor, and later for costumes and candy.

- There is an opportunity to increase merchandising for candy in LatAm. In Colombia, where Halloween is very popular, only 21% of stores took advantage of the holiday and displayed candy and chocolate. This is as opposed to the US, where 51% of displays catered to Halloween candy purchasers.

- Every day counts. About half of shoppers are hitting the stores until the very last days before Halloween. Don’t take the foot off the gas towards the end of the shopping season.

- The shopping window for Halloween is short. Closely monitor activation compliance and optimize execution with real-time, store-level data to increase your activation ROI.

Execute Data-Driven Strategies to Win Halloween

The research highlights the importance of data-driven planning and agile execution to capture Halloween sales. CPG brands must evolve their approach across the season and from region to region to take advantage of consumer shopping patterns.

That’s where Premise comes in. Premise helps CPG brands execute the right activation at the right time, no matter what or where you are selling. Our high coverage means we provide same-day store-level data you can directly share with your sales force.

Premise provides you with insight into store-by-store performance and compliance. We help you make adjustments on the fly–whether that’s a price-off against a competitor or trying a whole new tactic.

Learn more about how we have helped other CPG brands execute data-driven strategies:

- Enhancing Product Availability and Visibility with In-Store Insights

- Uncovering the Distribution of New Packaging Across Argentina

Learn more about Premise solutions and get started today.